Unlocking Better Home Loans: The Credit Score Secret for Indian Buyers

Introduction:

In the world of home loans, your credit score is your financial report card. It can be the

difference between a dream home and a disappointing rejection. Let's dive into the world of

credit scores and their crucial role in your homeownership journey.

Decoding Credit Scores: What They Are and How They're Calculated

- What is a Credit Score?

- A three-digit number representing your creditworthiness

- In India, ranges from 300 to 900, with 750+ considered good

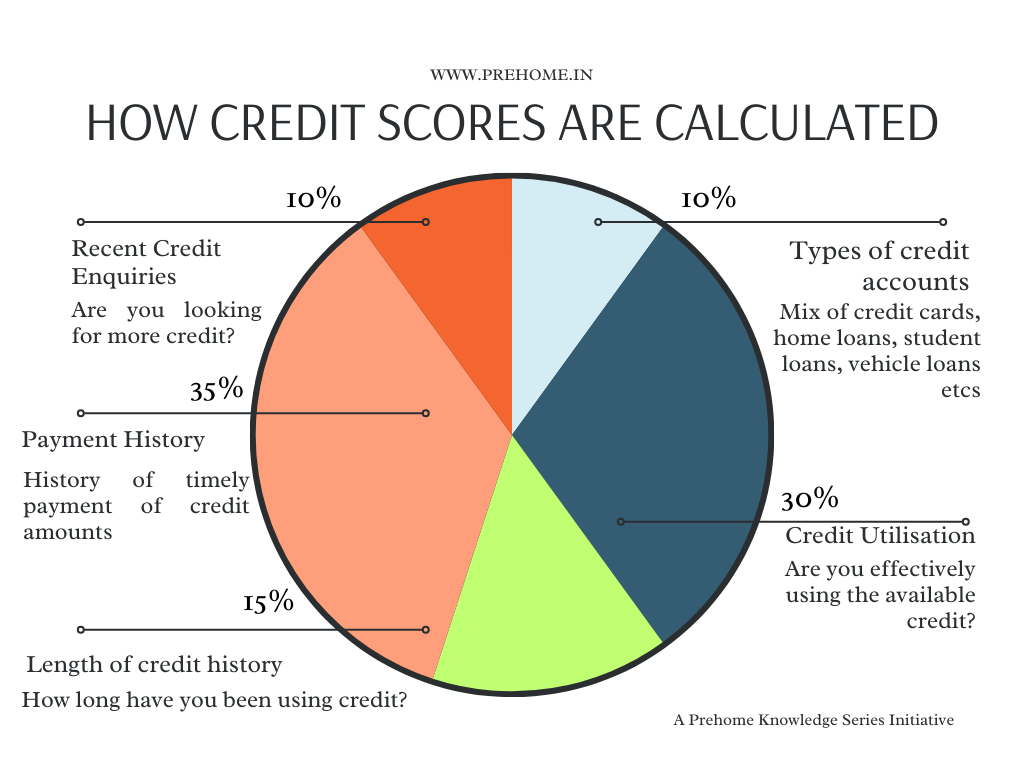

- How is it Calculated?

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Types of credit accounts (10%)

- Recent credit inquiries (10%)

The Impact of Credit Scores on Loan Approval and Terms

- Loan Approval

- Higher scores increase chances of approval

- Scores below 650 may lead to rejection or higher scrutiny

- Interest Rates

- Better scores can save lakhs in interest over the loan tenure

- Example: On a ₹50 lakh loan for 20 years

- 750+ score: 7.5% interest rate

- 650-700 score: 8.5% interest rate

- Difference in total interest paid: ₹12+ lakhs

- Loan Amount

- Higher scores may qualify for larger loan amounts

- Impacts the LTV ratio offered

Tips to Improve and Maintain a Good Credit Score

- Pay Bills on Time

- Set up auto-pay for credit cards and loans

- Keep Credit Utilization Low

- Aim to use less than 30% of available credit

- Maintain a Mix of Credit Types

- Responsible use of credit cards and loans shows creditworthiness

- Avoid Multiple Loan Applications

- Too many inquiries can lower your score

- Regularly Check Your Credit Report

- Dispute any errors promptly

How Rent-to-Own Arrangements Can Help Build Credit

- Consistent Payments

- Regular rent payments can be reported to credit bureaus

- Opportunity to Improve

- Time to build credit before applying for a traditional mortgage

- Lower Initial Requirements

- Easier entry for those with lower credit scores

Conclusion:

Your credit score is a powerful tool in your homeownership journey. Whether you're aiming for a

traditional home loan or considering alternative paths like rent-to-own, a good credit score

opens doors to better financial opportunities.