Supercharge Your Home Loan: Insider Tips for Indian Homebuyers

Introduction:

A home loan is more than just a means to buy property – it's a powerful financial tool that, when

used wisely, can offer numerous benefits. From government subsidies to tax advantages, let's

uncover how you can maximize the value of your home loan.

Government Schemes and Subsidies for First-Time Buyers

- IPradhan Mantri Awas Yojana (PMAY)

- Interest subsidy of 3-6.5% for first-time homebuyers

- Eligibility based on income category and property size

- ACredit Linked Subsidy Scheme (CLSS)

- Part of PMAY, offers interest subsidy on home loans

- Can save up to ₹2.67 lakhs on interest

- State-Specific Schemes

- Many states offer additional subsidies or benefits

- Research local programs in your area

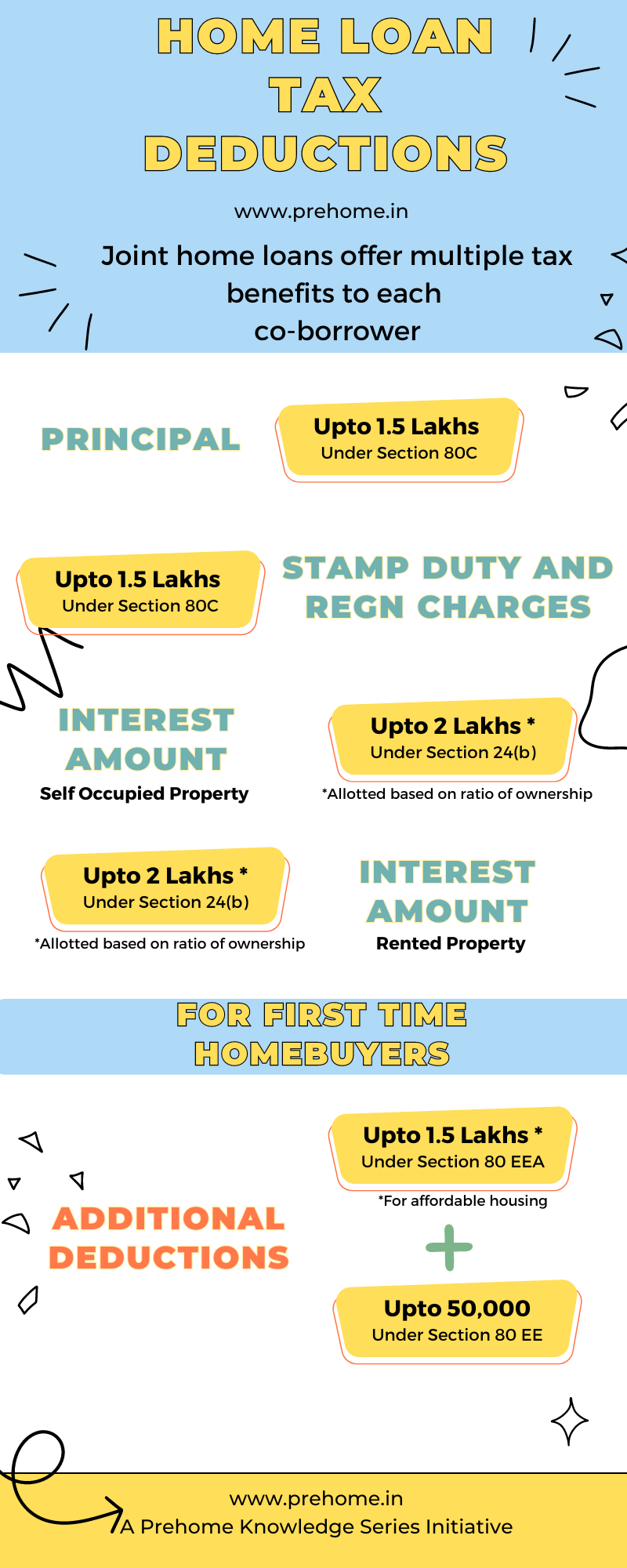

Tax Benefits of Home Loans

- Section 80C Deductions

- Up to ₹1.5 lakhs deduction on principal repayment

- Section 24 Deductions

- Up to ₹2 lakhs deduction on interest paid annually

- No upper limit for rented properties

- Section 80EE

- Additional ₹50,000 deduction for first-time homebuyers

- Specific eligibility criteria apply

- Joint Home Loan Benefits

- Both co-borrowers can claim tax deductions individually

Strategies for Efficient Loan Repayment

- Make Larger Down Payments

- Reduces loan amount and overall interest

- Opt for Shorter Loan Tenure

- Higher EMI but significantly lower total interest

- Prepay When Possible

- Use bonuses or windfalls to make partial prepayments

- Check prepayment charges and terms

- Step-Up EMI Plans

- Start with lower EMIs, increase over time with income growth

- Consider Balance Transfer

- Switch to a lower interest rate after a few years

Leveraging Home Loans for Wealth Creation

- Property Appreciation

- Benefit from value increase while paying current prices

- Rental Income Potential

- Use loan for investment property to generate passive income

- Loan Against Property

- Use home equity for other investments or emergencies

Rent-to-Own: An Alternative Path

- Savings Plan Built Into Rental Agreement

- Structured program to help save towards a future down payment

- Try Before You Buy

- Live in the home before committing to purchase

- Potential for Price Lock

- Agree on future purchase price, potentially benefiting from appreciation

- Credit-Building Opportunity

- Consistent rental payments may help improve credit score

Conclusion:

As we wrap up our exploration of home loans, it's important to remember that securing financing

is just one step in the homebuying process. Another crucial aspect is choosing the right

property that fits both your needs and budget.

In our next series, we'll dive into "Choosing Between Under Construction and Ready-to-Move-In

Properties." This guide will help you navigate the pros and cons of each option, considering

factors like timelines, costs, and potential risks. Whether you're leaning towards a brand-new

development or a move-in ready home, understanding these differences is key to making the best

choice for your situation.

Next in Our Series:

Join us as we unpack the important decision between under-construction and ready-to-move-in

properties. We'll explore the financial implications, timelines, and potential benefits of each

option to help you make an informed choice in your homebuying journey.