Smooth Sailing: Your Step-by-Step Guide to Home Loan Applications in India

Introduction:

Applying for a home loan can seem daunting, but with the right knowledge, you can navigate the

process with confidence. This guide will walk you through each step, helping you avoid common

pitfalls and increase your chances of approval.

Essential Documentation for Home Loan Applications

- Identity Proof

- AAadhaar Card, PAN Card, Passport, etc.

- Address Proof

- Utility bills, Rental agreement, etc.

- Income Proof

- Salary slips, Form 16, ITR for last 2-3 years

- Bank Statements

- Last 6 months of savings account statements

- Property Documents

- Sale deed, allotment letter, etc.

- Passport-sized Photographs

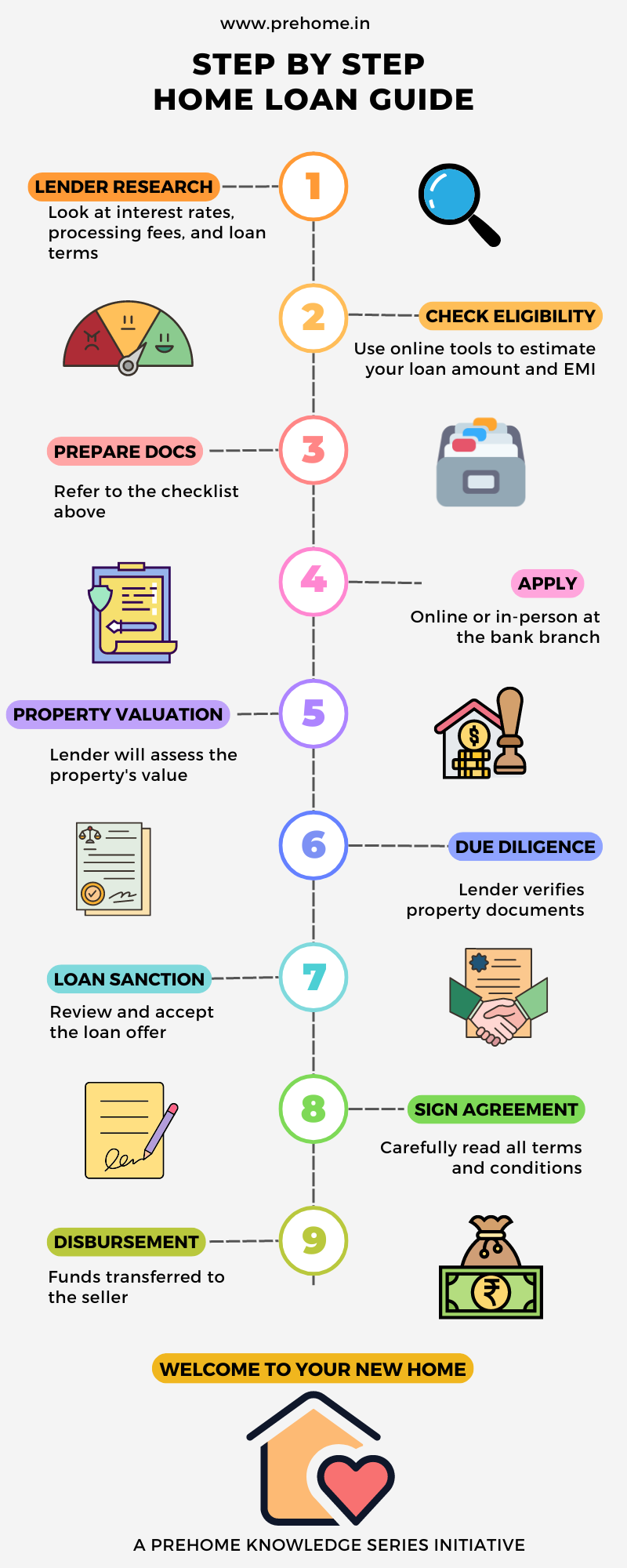

Step-by-Step Home Loan Application Guide

- Research and Compare Lenders

- Look at interest rates, processing fees, and loan terms

- ICheck Eligibility and Calculate EMI

- Use online tools to estimate your loan amount and EMI

- Gather Required Documents

- Refer to the checklist above

- Submit Loan Application

- Online or in-person at the bank branch

- Property Valuation

- Lender will assess the property's value

- Technical and Legal Verification

- Lender verifies property documents

- Loan Approval and Offer Letter

- Review and accept the loan offer

- Sign Loan Agreement

- Carefully read all terms and conditions

- Loan Disbursement

- Funds transferred to the seller

Common Pitfalls and How to Avoid Them

- Incomplete Documentation

- Double-check all required documents before submission

- Applying to Multiple Lenders Simultaneously

- Can negatively impact your credit score

- Ignoring the Fine Print

- Carefully review all terms and conditions

- Overestimating Affordability

- Consider all costs, not just EMI

- Neglecting Property Verification

- Ensure all property documents are in order

Alternative Paths: Rent-to-Own Programs

- Simplified Process

- Often requires less documentation initially

- Build Towards Ownership

- Time to improve financial standing before traditional mortgage

- Flexibility

- Option to purchase or walk away at the end of the term

Conclusion:

While the home loan application process can be complex, being well-prepared and informed can make

it significantly smoother. Remember, traditional home loans aren't the only path to

homeownership – explore all options, including rent-to-own programs, to find the best fit for

your situation.