As we conclude our series on down payments, it's time to explore why stretching your budget for a larger initial investment can yield significant long-term benefits. While the immediate impact of a bigger down payment is clear, its long-reaching effects on your financial health and homeownership experience are often overlooked. Let's uncover these hidden advantages.

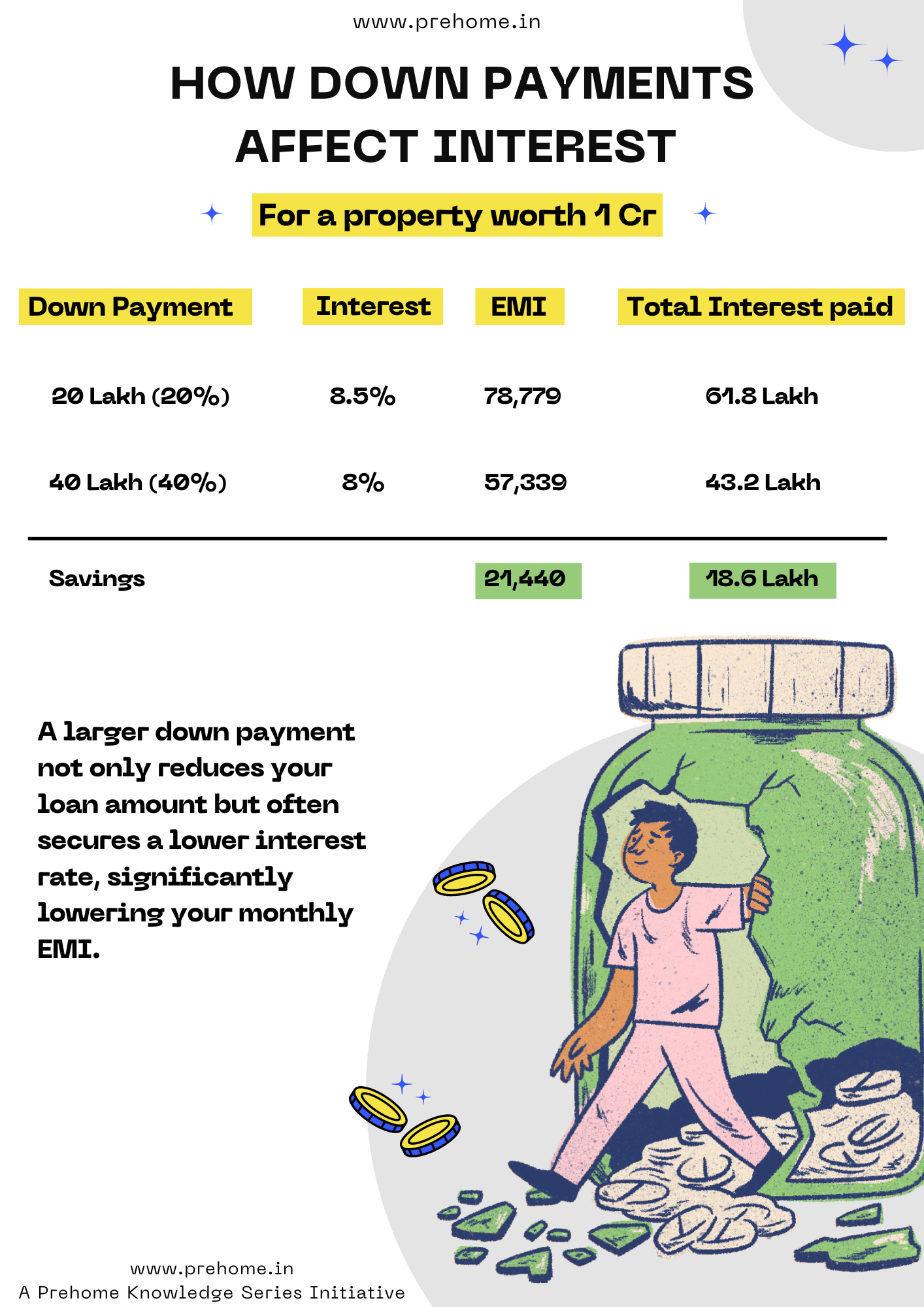

One of the most significant benefits of a larger down payment is the substantial savings on interest over time.

The larger your down payment, the less you need to borrow, directly reducing your total interest payment.

Total Savings with Larger Down Payment: ₹18.6 lakh

A larger down payment not only reduces your loan amount but often secures a lower interest rate, significantly lowering your monthly EMI.

A larger down payment means you start with more equity in your home from day one.

Equity = Property Value - Outstanding Loan Amount

In case of a market downturn, having more equity provides a buffer against negative equity situations.

A substantial down payment can open doors to better financing options.

Lenders often offer lower interest rates for larger down payments, as it reduces their risk.

While not common in India, some lenders might require mortgage insurance for low down payment loans. A larger down payment helps avoid this additional cost.

Throughout this series, we've explored the multifaceted world of down payments – from understanding their basic concept to strategies for saving and the long-term benefits of going big. We've seen that far from being a burden, a down payment is a powerful tool in your homeownership journey.

While we've explored the benefits and strategies of down payments, it's crucial to remember that they're just one part of the home buying process. For many first-time buyers, understanding and securing the right home loan is the next critical step.

Join us as we dive into the complex world of home loans in our upcoming series, "The Ultimate Guide to Home Loans for First-Time Home Buyers in India." We'll break down loan types, eligibility criteria, and essential tips to help you navigate this crucial aspect of home buying.