Master Your Down Payment: Proven Savings Strategies for Indian Homebuyers

Introduction:

In our previous blog, we explored the importance of down payments in the home buying process.

Now, let's tackle the next challenge: how to save for that crucial initial investment. Whether

you're aiming for the minimum 20% or striving for a larger down payment, these strategies will

help you reach your goal faster and more efficiently.

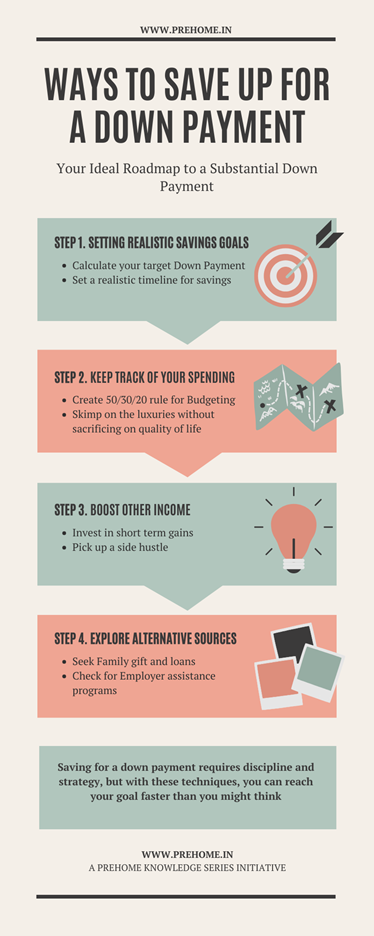

Setting Realistic Savings Goals

Before diving into saving strategies, it's essential to determine your target and timeline.

- Calculating Your Target Down Payment

- Decide on your ideal home price range

- Determine the percentage you aim to put down (20-40%)

- Calculate the total amount needed

Example:

- For a ₹1 Cr home with a 25% down payment goal:

- Target down payment = ₹1 Cr × 25% = ₹25 lakh

- Creating a Timeline for Savings

- Assess your current savings rate

- Determine how much you can increase your savings

- Calculate the time needed to reach your goal

Effective Budgeting Techniques

Proper budgeting is the foundation of successful saving.

- The 50/30/20 Rule for Budgeting

- 50% for needs (rent, utilities, groceries)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

Pro Tip: Allocate the entire 20% (or more) towards your down payment savings.

- Cutting Expenses Without Sacrificing Quality of Life

- Review and eliminate unnecessary subscriptions

- Opt for home-cooked meals over dining out

- Use public transport or carpooling to save on fuel costs

- Look for free or low-cost entertainment options

Boosting Your Income for Faster Savings

Increasing your income can significantly accelerate your savings rate.

- Side Hustle Ideas in India

- Freelancing on platforms like Upwork or Fiver

- Tutoring or online teaching

- Selling handmade items on platforms like Amazon Handmade

- Participating in the gig economy (food delivery, ride-sharing)

Investing for Short-Term Gains

- While saving, make your money work for you:

- High-yield savings accounts

- Short-term fixed deposits

- Liquid mutual funds

Caution: Stick to low-risk options for your down payment savings to ensure the funds are

available when needed.

Alternative Down Payment Sources

Explore additional options to boost your down payment fund.

Family Gifts and Loans

- Many Indian families assist with down payments. If considering this option:

- Clearly define whether it's a gift or loan

- Document the transaction for loan approval purposes

Employer Assistance Programs

- Some companies offer housing assistance benefits. Check with your HR department about:

- Housing allowances

- Low-interest loan programs

- Down payment matching programs

Conclusion:

Saving for a down payment requires discipline and strategy, but with these techniques, you can

reach your goal faster than you might think. Remember, every rupee saved brings you closer to

homeownership.

Next in Our Series:

Join us in the final blog of this series, where we'll explore "The Long-Term Benefits of a Larger

Down Payment," helping you understand why stretching for a bigger down payment might be worth

the effort.