Wealth Creation Strategies: Renting vs. Buying in India's Property Market

Introduction:

The decision to rent or buy a home in India isn't just about finding a place to live—it's a

crucial financial decision that can significantly impact your wealth-building potential. In this

final installment of our series, we'll explore how both renters and buyers can implement

strategies to grow their wealth, helping you make an informed decision that aligns with your

financial goals.

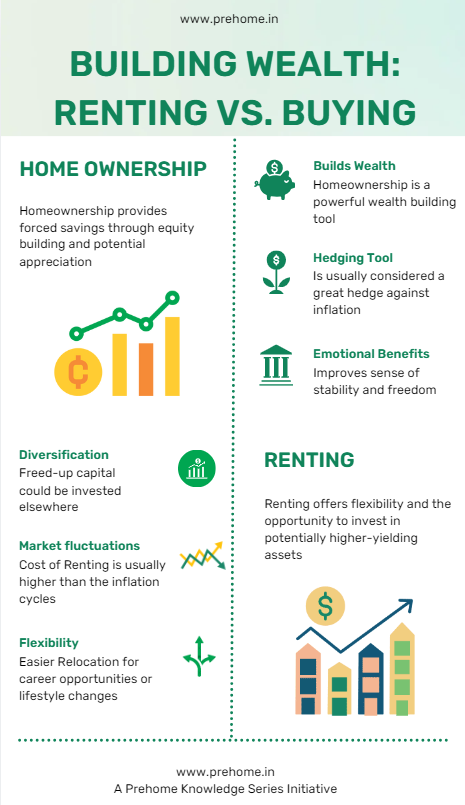

Equity Building Through Homeownership

How Mortgage Payments Build Equity

When you buy a home with a mortgage, each monthly payment contributes to your home equity—the

portion of your property that you truly own.

Example:

- For a ₹50 lakh home with a ₹40 lakh loan at 8% interest for 20 years:

- Initial equity: ₹10 lakh (down payment)

- Equity after 5 years: Approximately ₹15.5 lakh

- Equity after 10 years: Approximately ₹24 lakh

- This equity growth occurs through two mechanisms:

- Principal payments reducing your loan balance

- Potential appreciation in your home's value

Leveraging Home Equity for Wealth

- As you build equity, you can leverage it for further wealth creation:

- Home Equity Loans: Borrow against your equity for investments or major expenses

- Property Upgrades: Increase your home's value through strategic renovations

- Rental Income: Use equity to invest in additional properties for rental income

Investment Potential While Renting

Renting doesn't mean missing out on wealth-building opportunities. Here's how renters can grow

their wealth:

Investing the Down Payment

Instead of tying up a large sum in a down payment, renters can invest this money for potentially

higher returns.

Example:

- Assuming you save the ₹10 lakh that would have been a down payment:

- Invested in a diversified portfolio with an average 10% annual return

- After 10 years: Your investment could grow to approximately ₹25.9 lakh

Strategies for Renters to Build Wealth

-

- Systematic Investment Plans (SIPs): Regular investments in mutual funds

- Stock Market Investments: Direct equity investments for potentially higher returns

- Traditional Investment in Gold: Direct investment in appreciating assets like Gold

- Real Estate Investment Trusts (REITs): Participate in real estate markets without

buying property

- High-Yield Savings Accounts: For short-term goals and emergency funds

Opportunity Costs and Financial Flexibility

The Cost of Immobilized Capital

- Homeownership ties up a significant portion of your wealth in a single asset. Consider:

- Diversification: Renters can spread investments across various asset classes

- Liquidity: Easier access to funds for renters compared to homeowners

- Transaction Costs: Buying and selling property involves substantial costs

Flexibility in Career and Lifestyle Choices

- Renting offers:

- Easier Relocation: For career opportunities or lifestyle changes

- Lower Commitment: Ability to downsize or upgrade based on life stages

- Reduced Responsibility: No long-term maintenance or repair obligations

Real Estate as a Long-Term Investment

Historical Property Appreciation in India

- While past performance doesn't guarantee future results, let's look at historical trends:

- Average annual appreciation in major Indian cities: 5-10% over the past decade

- Compound effect: A ₹50 lakh property growing at 7% annually could be worth ₹98 lakh

after 10 years

Rental Income Potential

- Homeowners can generate wealth through rental income:

- Regular Income: Monthly rental payments can offset mortgage costs

- Tax Benefits: Deductions available on rental property expenses

- Long-term Appreciation: Benefit from both rental income and property value increase

Monthly expenses incurred by Renters Vs Homeowners

Conclusion:

Both renting and buying offer paths to wealth creation, each with its own advantages and

considerations. Homeownership provides forced savings through equity building and potential

appreciation, while renting offers flexibility and the opportunity to invest in potentially

higher-yielding assets.

Your choice should align with your financial situation, risk tolerance, and long-term goals.

Remember, the best wealth-building strategy is one that you can consistently follow and adjust

as your life circumstances change.

Ultimately, whether you choose to rent or buy, the key to building wealth lies in disciplined

saving, smart investing, and making informed financial decisions that align with your unique

situation and goals.

Next in Our Series:

Now that we've explored the financial aspects of renting vs. buying, it's time to dive deeper

into the practicalities of homeownership. Join us in our next series, "Navigating the Home

Buying Process," where we'll guide you through every step of purchasing your dream home in

India. From choosing the right property to understanding home loans, we've got you covered!